Unsecured Lending System

Unsecured loans form a key part of a bank’s service portfolio. Our system provides a comprehensive solution covering the entire lending process — from loan application (including requests submitted via partners), through borrower identification (using both internal and external data sources), to document generation, contract signing, and disbursement.

Given the dynamic regulatory environment, evolving risk management strategies, and ongoing product development initiatives within banks, our solution offers full parameterization at the client level. This ensures flexible adaptation to changing conditions — all without modifying the underlying code.

Business Advantages

• Complete coverage of the loan process and full credit lifecycle• Cost-efficient implementation with optimized processes, adjustable rules, and workflows

• No license fees for proprietary modules (the full application source code becomes the property of the bank)

• System optimized for the bank’s own business processes

• Rapid response to market demands

• User-friendly interface – business users can configure fields independently

• Fast integration with core banking systems (e.g. account management)

• Based on prior experience, business-critical products were implemented and operational within one year

Supported Segments

The system is designed for Retail and Sales Partner environments.Supported Products

ÁRUHITEL

SZEMÉLYI KÖLCSÖN

FOLYÓSZÁMLA HITEL

Hitelkártya (instant és virtuális)

Main Modules

DATA ENTRY

CREDIT ASSESMENT

CARD MANAGEMENT

Disbursement

Reporting

End-of-day Processing

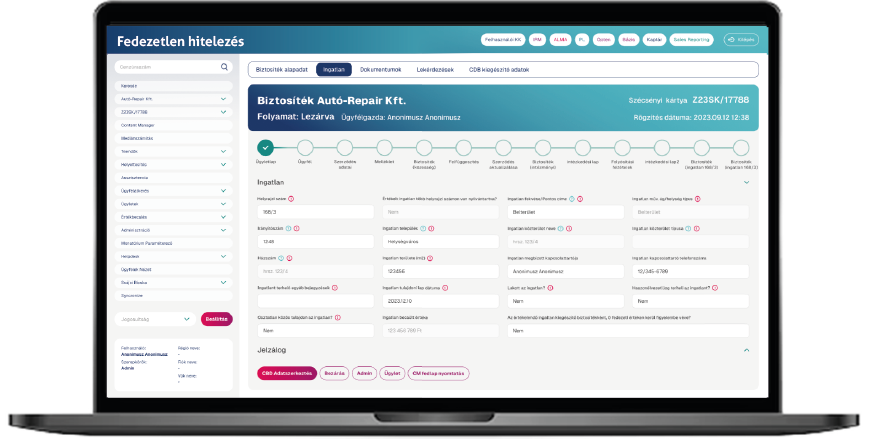

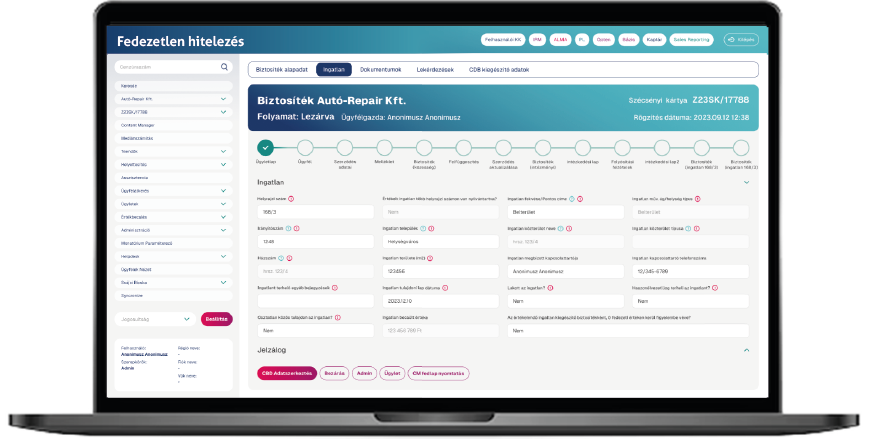

A dedicated module for recording retail loan products, used by branch and third-party agents to input loan applications. Within this module, users can print required documents (e.g. Contracts, Application Forms) and personalize instant card products. Loan applications can be initiated and recorded here.

• Prepare preliminary offers for potential clients (Retail Loan, Credit Card, First Transaction Card, Installment Product)

• Record loan applications with customer data retrieval, KHR and Opten checks (Retail Loan, Credit Card, First Transaction Card, Instant Card, Personal Loan, Installment Product, Overdraft Facility)

• Record loan refinancing requests

• Display the results of credit assessments

• Personalize instant cards

• Modify transactions, release goods

• Cancel transactions or loan applications

• Print all relevant documents (Contract, Application Form, KHR Declaration, Receipts, etc.)

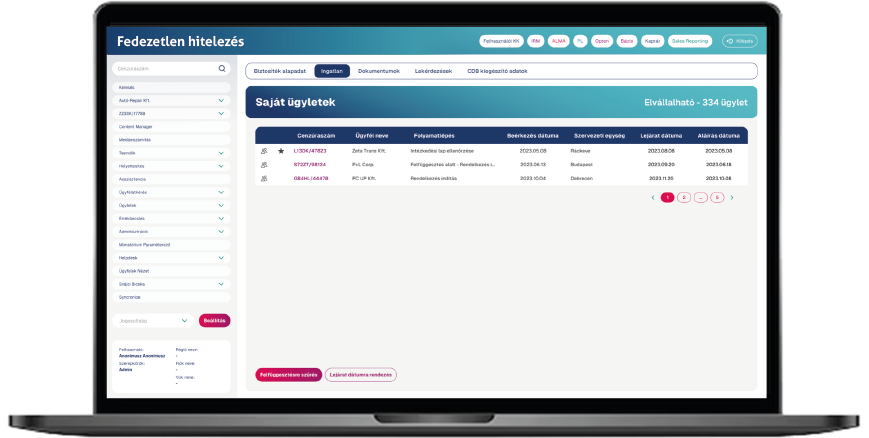

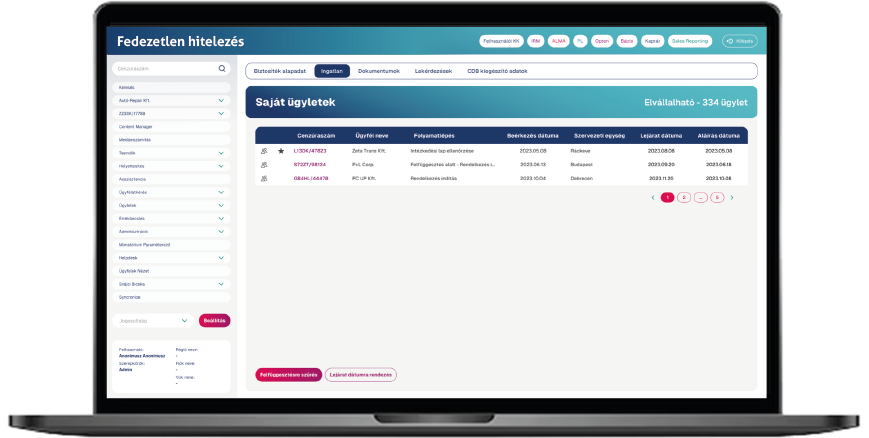

A module designed to evaluate various loan applications (Retail Loan, Personal Loan, Overdraft, Credit Card) submitted via branches or merchants.

Cancellation – withdrawal of a loan application

• Suspension – in case of missing documentation or data

• Manual Review – if the applicant’s eligibility cannot be clearly determined

• Return to Data Entry / Data Modification – enables correction of client or transaction data

• Rejection – when the client fails to meet eligibility or risk requirements

• Approval – if the applicant meets all criteria, the loan can be approved either automatically or manually by the assessor

During card registration, a so-called dummy card can be assigned to the application, allowing the client to use their credit card immediately without waiting for postal delivery. The Card Management application tracks the entire lifecycle of these dummy cards, from production to deactivation.

• Card production – issuing new dummy cards

• Stock intake – scanning newly produced cards into the system (barcode supported)

• Weekly stock control – monitoring usage, setting alerts and daily reports to support production scheduling

• Return process – handling blocked, damaged, or expired cards, ensuring final deactivation in the system

If a loan application is approved, the system triggers autometic disbursement. Account details are displayed to the user, and both SMS and email notifications are sent to the client.

• Preparation of instruction and disposition sheets

• Automatic generation and personalization of documentation

• Legal review and custom modifications

• Disbursement conditions and execution

• Integration with the core banking/account management system

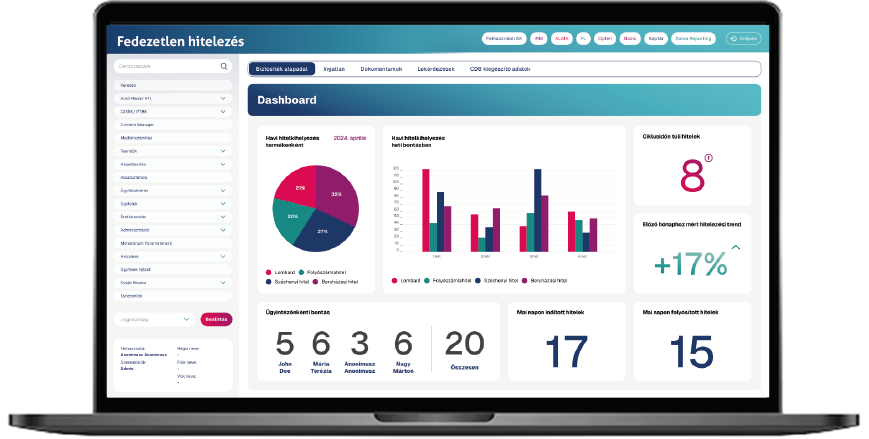

The reporting module consists of two main parts: a frontend for displaying and generating reports, and an automated background process that creates report files during end-of-day operations.

• Authentication and authorization

• Operational reports (user activity, statistics)

• Dashboard overview of generated and ongoing reports

• Report generation via user interface – with or without parameters (depending on report type), processed asynchronously so multiple reports can be run simultaneously

• Generated reports remain downloadable for a set number of days before automatic deletion

• Full logging – every report generation event is tracked (user, time, parameters used)

A multi-step procedure handling large data transfers, data exports, and system integrations after banking hours. The process is manually initiated by operations staff and includes an internal scheduler that manages job order, execution, and status (via Oracle jobs). The final step is completed by system operations.

• Data transfer to account management systems – finalized transaction data sent via stored procedures (DBLink)

• File generation for the account management system – structured files are produced, encrypted with PGP, and placed in a secure directory

• Data exports for overdrafts and credit cards

• Real-time reporting and monitoring of all end-of-day processes

Additional Functionality

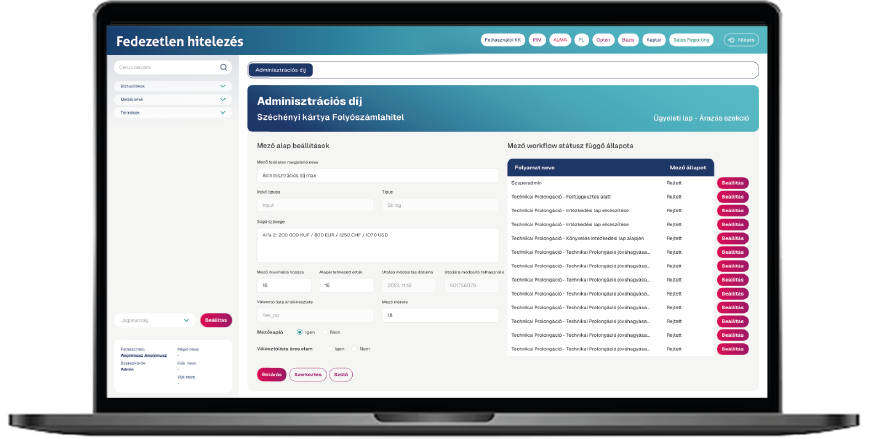

This module provides the management of configurable parameters within the system. Users can set system parameters according to their access rights, and after saving the configurations, the updated parameters become available for all operators. The parameters each user can manage depend on their authorization level.

• System administrator settings (master parameters)

• User management: registering new users, modifying existing ones, activation/inactivation, managing and assigning roles and permissions

• Insurance parameter settings

• Parameterization of products, merchants, cards, and customer types, as well as defining relationships between them

• Parameterization of codes and various flags set during data entry

• Pricing parameters

• Card registry parameters

• General parameters and parameter groups

• Authentication and authorization

• Fraud and business databases

The KHR Calculator module supports the work of the Risk Department and the operations staff involved in the retail lending process by simplifying their tasks and enabling searchable access to KHR (Central Credit Information System) data. Its purpose is to calculate the installment amount and loan sum for each case based on KHR queries and to display KHR-based alerts for the operator.

• Calculation rules (warning: displays alerts according to rules; installment usage: related to installment calculation; calculation: general rule type)

• Authentication and authorization

• Exchange rate uploads

• KHR responses

• Creating and deactivating calculation rules

• “Workbasket” view of all previous KHR responses and their related calculations

• KHR simulator for supporting test and development environments

The Upload module is a modular thick-client application where each program component is stored in separate files and uploaded to a shared folder via an API.

• Listing, downloading, and uploading of files; report generation

• Supported file types: Announcement, Template, Application

• Templates may include: email, fax, or contract templates

Future proof, modern technologies

The application is easily customizable to meet modern technological requirements, including cloud solutions (AWS, MS Azure) and database technologies (Oracle, EDB).• WebLogic

• EDB

• Java, Spring Framework

• ReactJS front-end framework (fully responsive design)

• Maven, Jenkins

• Sonar, Burp (security testing)

• Workflow engines: Camunda, JBPM, Activiti

• Decision engine: Camunda

• Test automation: Selenium, JMeter

Related Products

Several of our solutions can be integrated with the corporate lending system, such as:• Document generator

• Central retrieval module

• KAVOSZ