Mortgage lending origination system

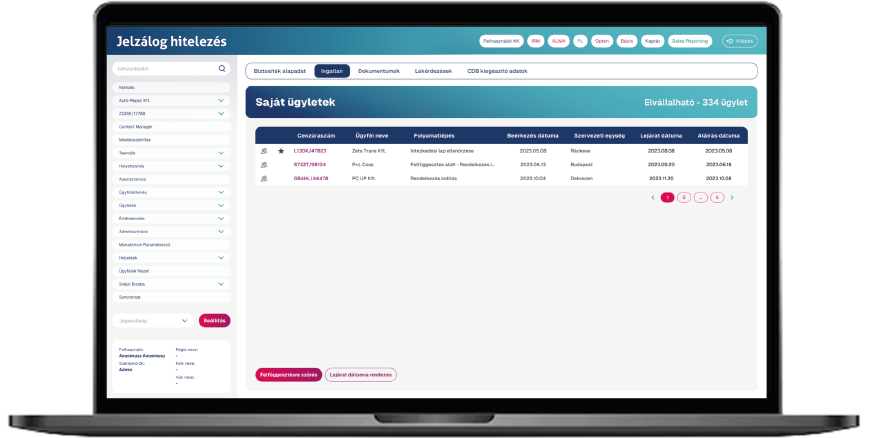

Our mortgage lending system consists of three main parts: the offering system, the scoring and scheduling system, and the follow-up system. Our solution, which covers the entire residential mortgage lending process, has been proven in practice and has managed 10,000 processes annually.

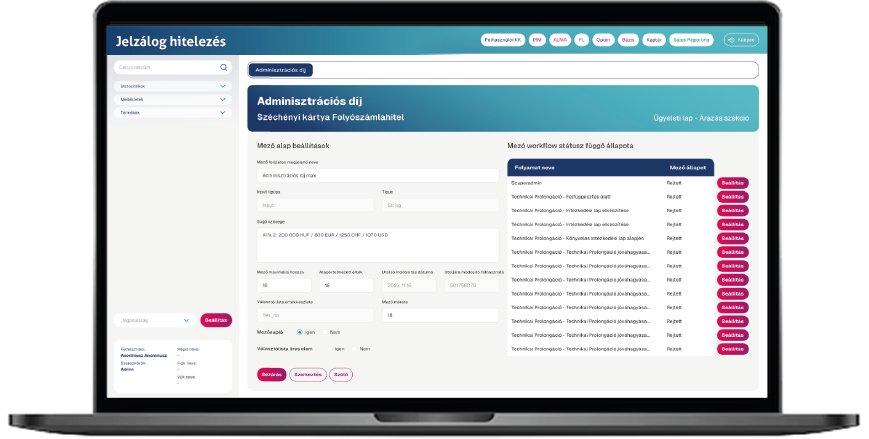

In line with business needs and the legal environment, rapid changes are required during loan approval, therefore easy parameterization and the ability to change documents in-house were given special importance during the development process.

Business advantages

• Fast adaptation options using ready-made components• On-premise or Cloud solutions

• Complex integration (WS, Rest, oData), easy replacement of legacy systems using ready-made integration solutions

• Modern, future proof technology

• Integration with the branch frontend system

Supported segments

The system was designed for the residential system.Supported products

MARKET CREDIT

MARKET FREE USE CREDIT

Mortgage bond interest-subsidized loan

Additional interest subsidy loan

Lending of subsidies

Debt consolidation loan

Main modules

Merchant support

Credit assessment process

Contracting

Disbursement

Data providing

Follow-up

Workflow specific elements

• Management of mortgage offers issued by the bank

• Stores the available constructions up to date, so you can perform installment, schedule, and other calculations

• Personal and property-related data request for the calculation

• The offer is supported by a calculator that can be made public to customers, where product selection can also be made

• The official offer takes its final form with the help of a parameterizable document generation application

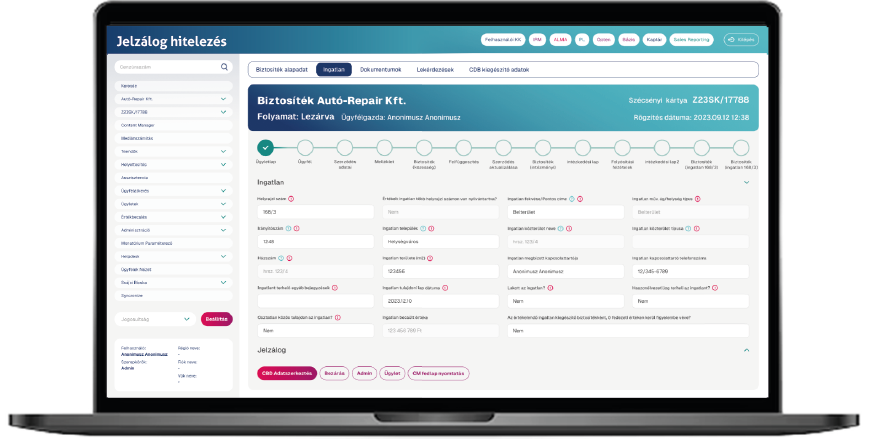

• Data recording and verification based on personal, real estate and product information

• Risk management, and in the case of standard loans, transaction decision after decision preparation

• Contract preparation (verification, involving the legal department) using a document generation application

• Contract signing (also with electronic signature)

• Internal and external system connections (e.g. KHR, Land Office)

• Verification of disbursement conditions

• Data transfer to the accounting system, loan disbursement

• Related processes: valuation, creditworthiness check, technical inspection, insurance, PPI process

• Preparation of state treasury reports

After disbursement, it manages the processes up to the closing of the loan

• Collateral and participant exchange

• Collateral deposit and withdrawal

• Maturity change

• Partial and full prepayment

• Refinancing-related processes

• System connections to the system that manages the generation and storage of contracts, the account management system, and other external partners (e.g. in connection with refinancing)

Future proof, modern stack:

The application can be easily customized to meet today's technology requirements, including cloud solutions (AWS, MS Azure) and database technologies (Oracle, EDB).• Java technologies

• LDAP/AD authentication

• Spring

• Apache Kafka

• Oracle or EDB

Related products:

Many of our solutions can be linked to our corporate lending system, e.g.• Document generator

• Central retrieval module