CORPORATE CREDIT ORIGINATION SYSTEM

A complex multi-layered, distributed workflow management system that covers the entire loan application process, data entry, verification, scoring, risk management, contracting, disbursement for all available products. Implementation within months, after which, according to our experience, Time to yes/time to cash can be reduced by 40-60%, while the number of documents can be reduced by 50%.

Business advantages

• Full loan lifecycle coverage• Cost-effective implementation with optimized processes, modifiable rules, workflow

• No license fees for own modules (the entire application source code is owned by the bank)

• System optimized for the bank's own business processes

• Fast response to market needs

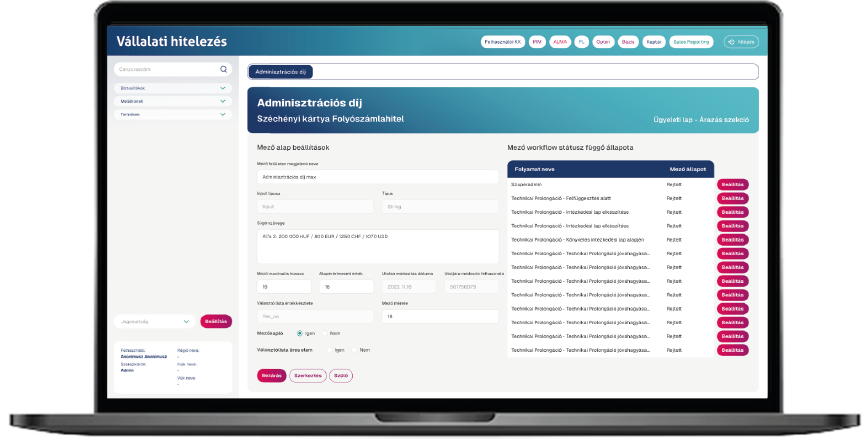

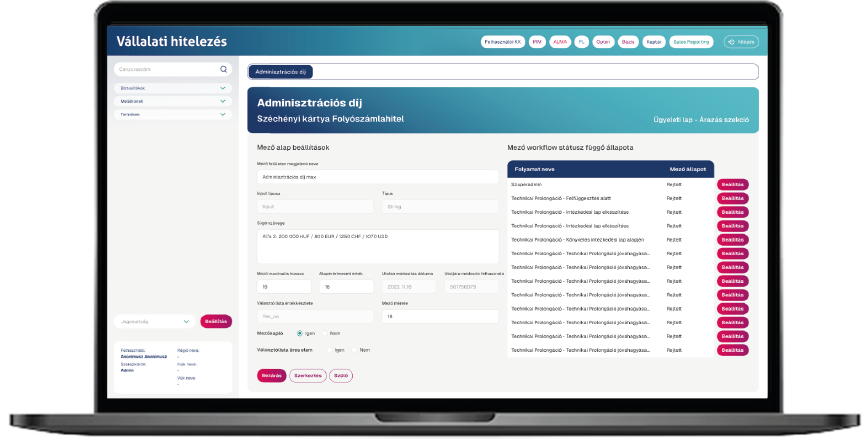

• Easy-to-use interface: fields can also be parameterized by the business side

• Fast integration with core banking systems (e.g. account manager)

• Very fast implementation of business-critical products up to disbursement

Supported segments

The system was designed for micro, SME and corporate sector.Supported products

BUSINESS LOANS

INVESTMENT LOANS

SZÉCHENYI LOANS

CURRENT ACCOUNT LOANS

REVOLVING CREDITS

SHORT AND LONG TERM LOANS

OPERATION LOANS

MORTGAGE LOANS

REFINANCING LOANS

BANK GUARANTEES

Main modules

Customer management

Transaction decision

Valuation

Contracting

Disbursement

Monitoring

Reports

Customer management

• Customer basic database

• Opten integration,change management

• Complex authorization management (CRM / assistant, branch, region)

• Customer inquiry module (to modify a customer's current contact person)

• Negotiation report management

• Queries (automated KAR, BAR, KHR, OPTEN, GIRINFO, internal systems)

• Financial data, debtor ratings management

• Limit tables, limit management

• Verification questions management module

• Customer basic database

• Opten integration,change management

• Complex authorization management (CRM / assistant, branch, region)

• Customer inquiry module (to modify a customer's current contact person)

• Negotiation report management

• Queries (automated KAR, BAR, KHR, OPTEN, GIRINFO, internal systems)

• Financial data, debtor ratings management

• Limit tables, limit management

• Verification questions management module

Transaction decision

• Data recording

• Transaction data, collateral, customer data

• Automatic recording

(copying, loading from external system )

• Verification

• Customer, financial, collateral, transaction

• Decision

• Automatic

• Manual – risk management proposals, senior management decisions

• Lobby branches

• Data recording

• Transaction data, collateral, customer data

• Automatic recording

(copying, loading from external system )

• Verification

• Customer, financial, collateral, transaction

• Decision

• Automatic

• Manual – risk management proposals, senior management decisions

• Lobby branches

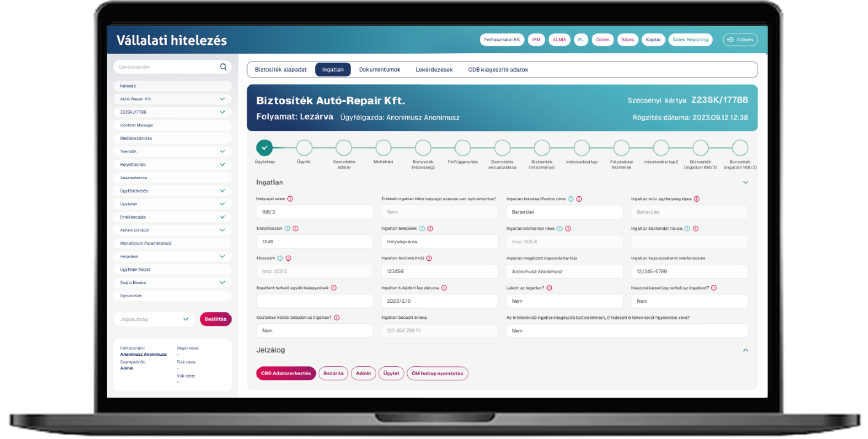

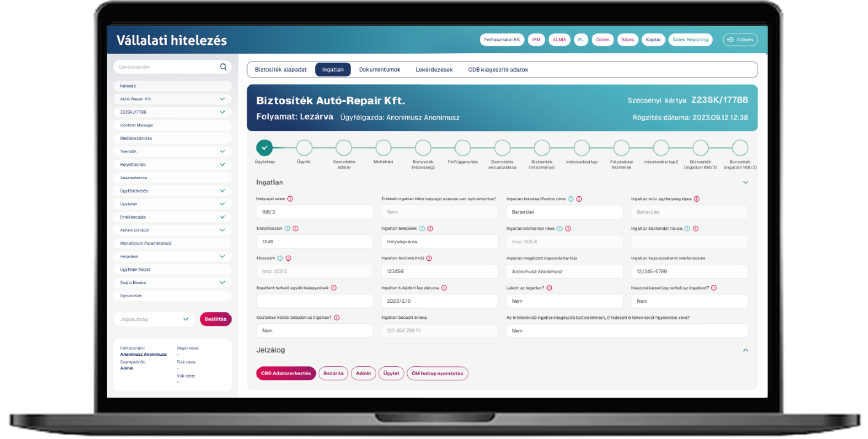

Valuation

• Valuation order (external / internal appraiser management)

• Valuation

• Valuation verification

• On-site inspection

• Valuation order (external / internal appraiser management)

• Valuation

• Valuation verification

• On-site inspection

Contracting

• Contract package generation (automatic generation, personalization)

• Custom modifications, Legal opinion

• Contract terms verifications

• Contract finalization, signature

• Contract package generation (automatic generation, personalization)

• Custom modifications, Legal opinion

• Contract terms verifications

• Contract finalization, signature

Disbursement

• Preparation / order sheets

• Automatic generation with personalization

• Modifications, Legal verification

• Conditions

• Liquidation

• Connection with the account management systems

• Preparation / order sheets

• Automatic generation with personalization

• Modifications, Legal verification

• Conditions

• Liquidation

• Connection with the account management systems

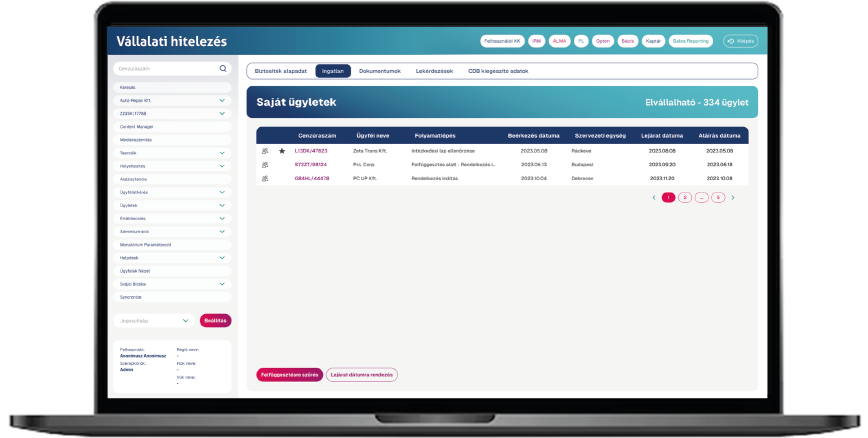

Monitoring/ToDo

• Tasks that can be assigned to a customer, transaction, or dedicated contact

• Manual creation / custom task

• Automatic creation (e.g., delinquency, account turnover, collateral related / e.g., Savings account integration, expiration monitoring)

• Task creation

• Task execution / involvement of another department (e.g., collections)

• Tasks that can be assigned to a customer, transaction, or dedicated contact

• Manual creation / custom task

• Automatic creation (e.g., delinquency, account turnover, collateral related / e.g., Savings account integration, expiration monitoring)

• Task creation

• Task execution / involvement of another department (e.g., collections)

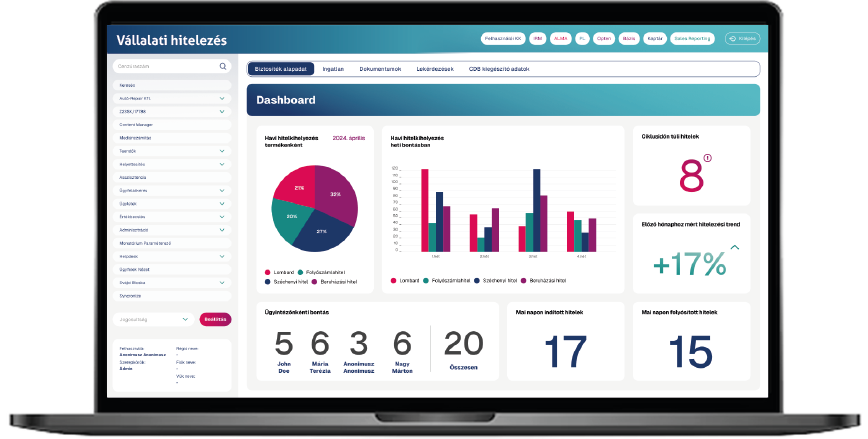

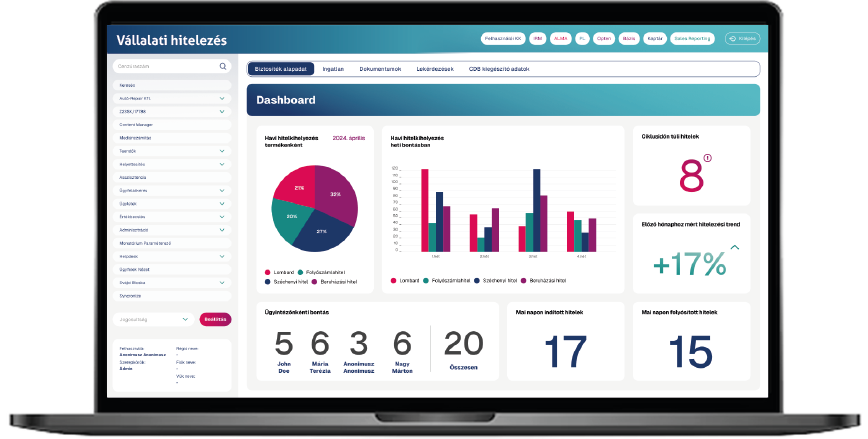

Reports

• Cycle time measurement (per module, per process step, TTY, TTC)

• Analysis of suspensions

• Reports related to customers, deals

• Trends, comparison (monthly, annual, YTD, etc.)

• Cycle time measurement (per module, per process step, TTY, TTC)

• Analysis of suspensions

• Reports related to customers, deals

• Trends, comparison (monthly, annual, YTD, etc.)

Future proof, modern technologies:

• OnPremise / Cloud (AWS, Azure) running• Java cluster support, multi-server capability, failover support

• Decision engine integration (e.g.: Power Curve)

• WF process control engine (e.g.: Camunda)

• Modern frontend interface, reusable components: Angular/React

• Modern backend technology: NodeJS

• Modular usability

• PostgreSQL EDB (up to 80-90% savings compared to Oracle licenses)

Related products:

Many of our solutions can be linked to our corporate lending system, e.g.• Document generator

• Central retrieval module

• KAVOSZ