Valuation system

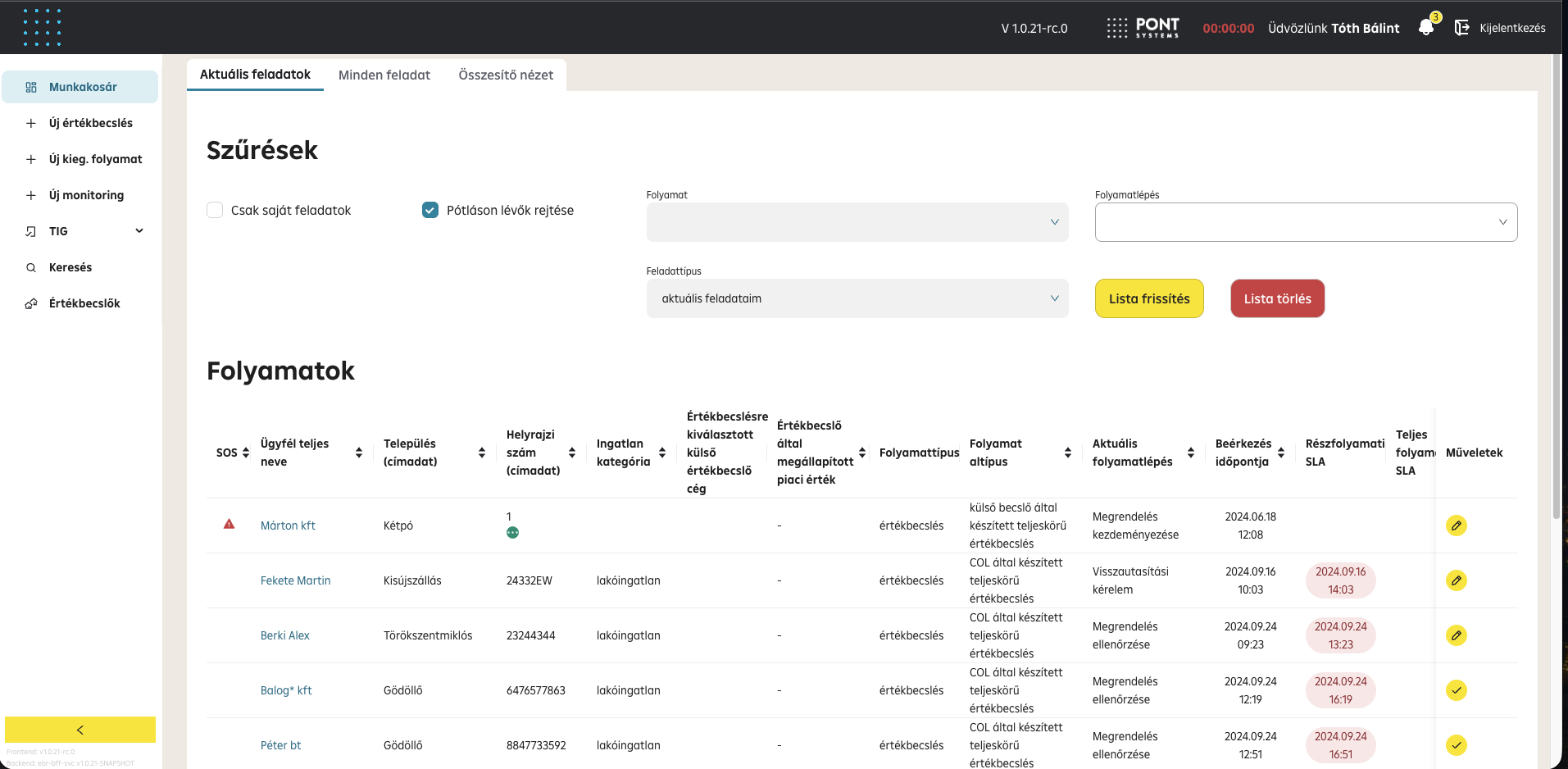

The system fully covers the banking valuation process with the following functionality:

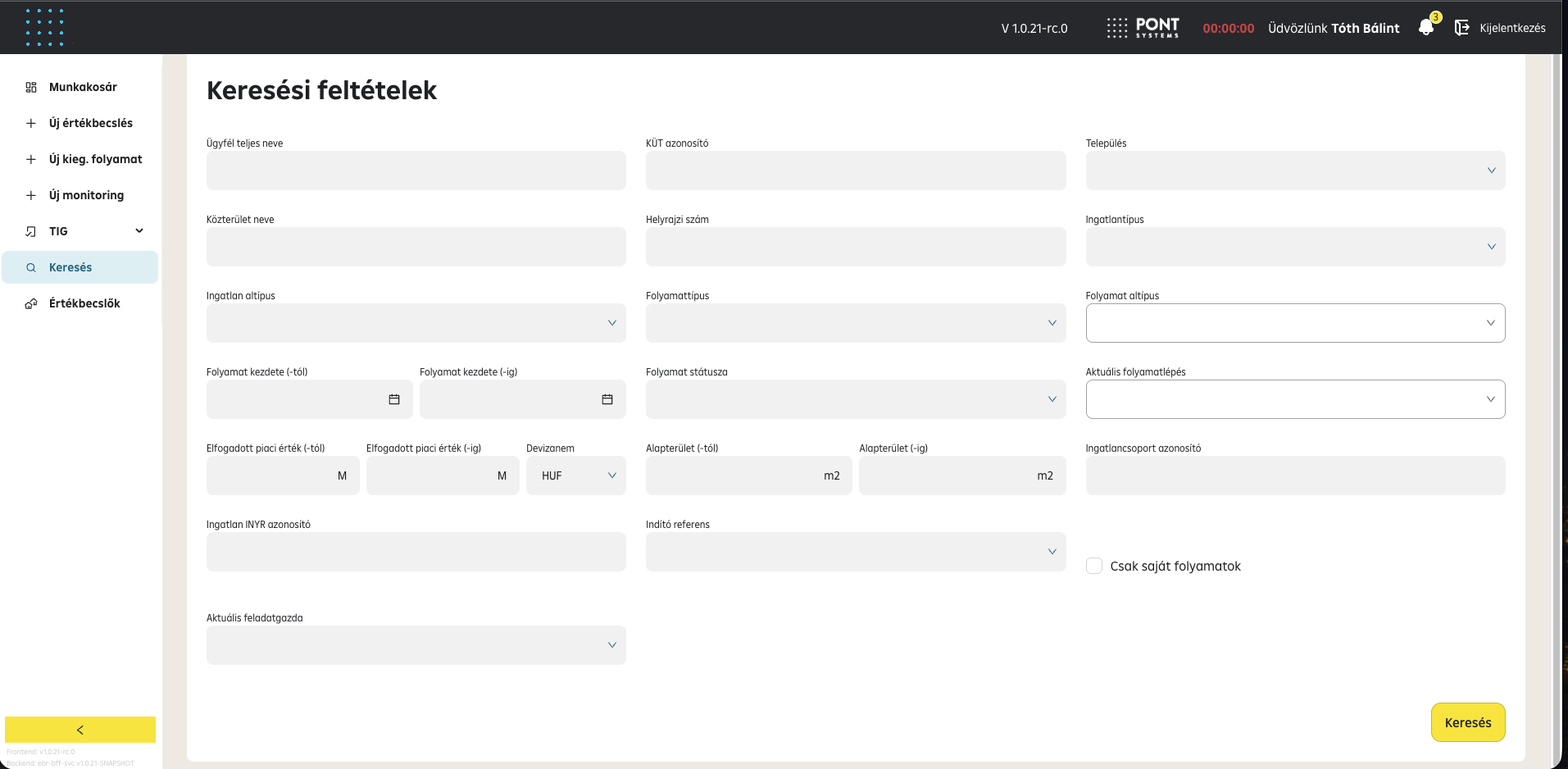

Process support functions

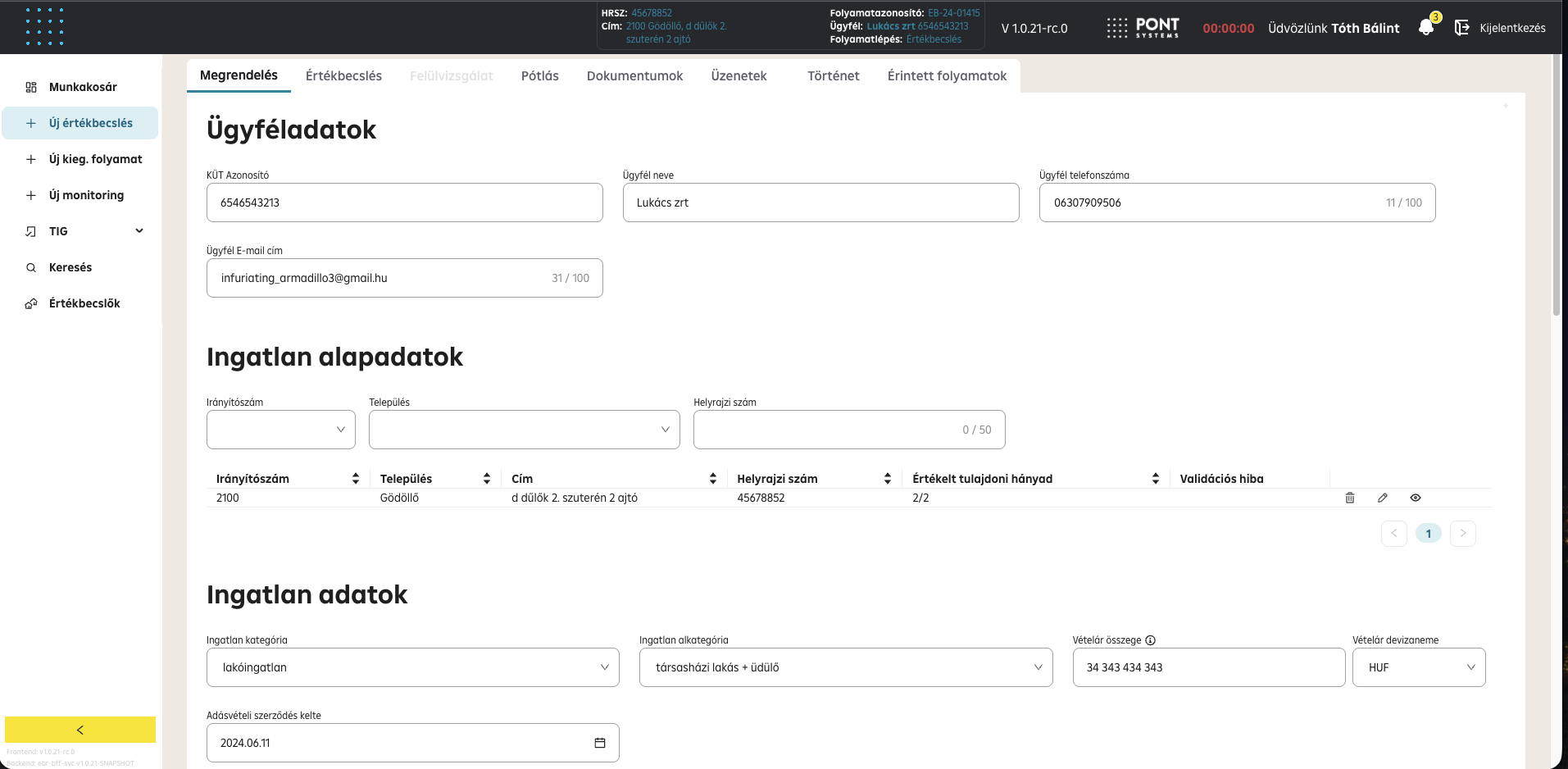

- It manages both valuations required for lending processes, independent or preliminary valuations (these can be linked to lending processes later)

- Management of partners (valuators) (new recording, modification, suspension) - four-eye principle

- Management of SLAs (parameterizable)

- Management of cycle times, reporting

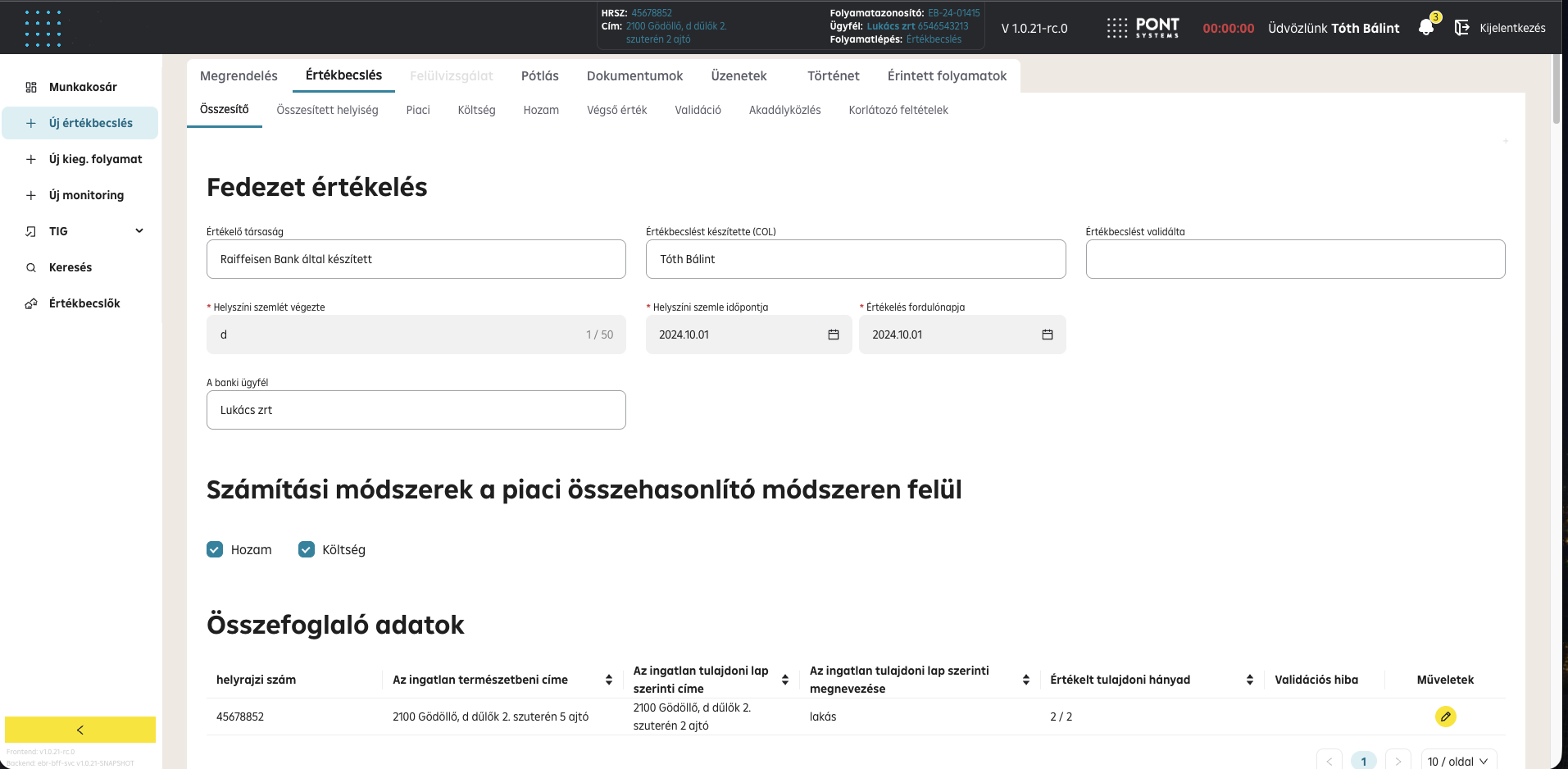

- Support for statistical valuation

Support for documentation functions

- Possibility of attaching documents (parameterized to authorization and process step)

- Support for generating documents (connection to the Bank's document generation service)

Functions of external valuers

- Appraiser data management

- Separate interface designed for external appraisers

- Support for multiple roles as an appraiser (manager, assistant, appraiser)

- Data entry forms required for valuation

- Management of SLA and related deadlines (configurable)

- Management of settlement, commission and fee calculations (configurable)

- Preparation and management of performance certificates

Related process functions

- Support for monitoring functions required for collateral

- Support for related processes (periodic reviews, reassessments, changes, etc.)

- Manage settlements with appraisers

- Storage of appraisers' data, management of assessments

- Data transfer for the KBR system

Technological features

- React FE

- JAVA BE

- Separate external (estimators) and internal (operation) modules

- PostGreSQL data storage

- IF connections with KAFKA, RestAPI or file generation and output

- System operation in OnPrem or cloud (currently AWS) environment

- Cognito, PingFederate authentication support